Table of Contents

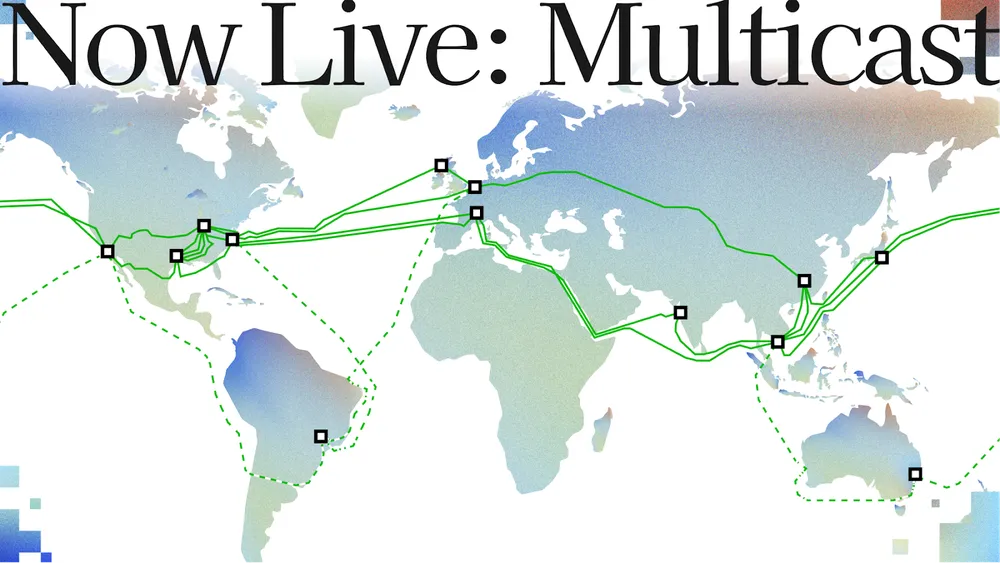

World Liberty Financial has launched its first web-based product, World Liberty Markets, marking a major step in expanding the real-world utility of its USD1 stablecoin through lending and borrowing services powered by the DeFi protocol Dolomite.

The new platform enables users to supply USD1 and other supported assets as collateral to access borrowing opportunities, bringing decentralized credit functionality to the World Liberty Financial ecosystem for the first time. Through the platform, users can supply assets to earn yield, borrow against their collateral, and deploy borrowed liquidity into additional strategies.

Earn Yield on USD1

World Liberty Markets supports USD1 alongside several major digital assets, including WLFI, Ether, Coinbase Wrapped Bitcoin (cbBTC), USDC, and USDT. The protocol is built on Dolomite’s existing infrastructure, which is designed to facilitate lending, borrowing, and collateralized positions in a decentralized environment.

World Liberty Markets is now live, built to give users access to transparent, high-performance liquidity markets provided by @dolomite_io. You can earn on supplied assets or borrow against your portfolio with fast, flexible liquidity. WLFI Markets is designed to make these tools…

— WLFI (@worldlibertyfi) January 12, 2026

Expanding the Use Cases for USD1

USD1, a fully backed U.S. dollar stablecoin issued by World Liberty Financial, has grown rapidly since its launch. The token recently surpassed $3 billion in circulating supply and has seen increasing trading volume across major cryptocurrency exchanges.

With the rollout of World Liberty Markets, USD1 holders can now deploy their stablecoins in lending strategies, earn yield by supplying liquidity, or borrow against supported collateral assets.

"A year ago, we set out to build a stablecoin that could compete with the biggest names in crypto, and USD1 has exceeded every expectation," said Zak Folkman, Co-Founder and COO of World Liberty Financial. "Now we’re giving USD1 users access to even more ways to put their stablecoins to work. World Liberty Markets is a major step forward, and it's just the first of many products we're planning to roll out over the next 18 months.”

The platform also integrates World Liberty Financial’s USD1 Points Program, allowing eligible users who supply USD1 to earn reward points based on their activity. The official description of the program is as follows:

"The USD1 Points Program recognizes users who hold or use USD1 across supported platforms. When you supply USD1 on Dolomite through WLFI Markets, you can earn USD1 Points that track your participation in the ecosystem. USD1 Points are a rewards metric that may support future program features as the ecosystem expands. They are not a token, financial return, or guaranteed incentive. They simply reflect your ongoing engagement with USD1. You may also earn USD1 Points on partner platforms that support USD1 activity. Availability, earning rules, and eligibility on those platforms are determined by each partner's terms and conditions. Program availability and participation may vary based on jurisdiction and partner support."

A Broader Product Roadmap

The release of World Liberty Markets aligns with the company’s broader roadmap to expand USD1’s role across financial services.

Previously announced initiatives include:

- Exploring tokenized real-world assets

- Improving on- and off-ramp infrastructure

- Enabling USD1 usage through card-based payment solutions

World Liberty Markets is currently available as a web application on the company’s website, with a mobile app expected to follow.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice. The information provided should not be interpreted as an endorsement of any digital asset, security, or investment strategy. Readers should conduct their own research and consult with a licensed financial professional before making any investment decisions. The publisher and its contributors are not responsible for any losses that may arise from reliance on the information presented.