Table of Contents

Liquid restaking on Solana is a DeFi strategy that lets you stake SOL, receive a tradeable liquid staking token, then deposit that token into a restaking protocol to secure additional services and earn extra yield.

Native staking has a capital efficiency problem: you lock SOL, it secures the network, and you earn 6–8% APY. But your tokens sit unavailable while the rest of DeFi happens without them.

Liquid staking improves on this model by letting you stake SOL and receive a liquid token (like INF or fwdSOL) that represents your position. The underlying SOL still secures the network and earns rewards, but you can sell, lend, or use your token as collateral.

Liquid restaking adds a third layer. You take your liquid staking token and deposit it into a restaking protocol, where it backs additional services like oracles and MEV routers. Each service pays for the security you provide, stacking yield on top of your base staking rewards.

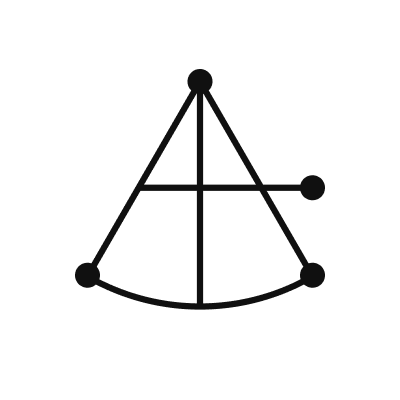

How Does Liquid Restaking Work On Solana?

Each layer of the stack keeps the layers below it running. Your SOL still earns base rewards, your LST still trades and compounds, and the restaking layer adds yield on top.

On Solana, restaking protocols secure Node Consensus Networks (NCNs)—services like Switchboard oracles, Ping Network, and MEV infrastructure that need economic security but don't want to build their own validator sets. When you deposit your LST, you receive a liquid restaking token (LRT) or vault receipt token (VRT) that tracks your share of the vault. As NCNs pay for the security you provide, rewards accrue to your position and the token appreciates.

Combined returns can exceed 10% APY, and users who add a fourth layer by lending their LRTs or providing liquidity can push substantially higher.

Liquid Restaking Across Ecosystems

Liquid restaking started on Ethereum with EigenLayer in 2023, and the concept has since spread to nearly every major blockchain.

EigenLayer remains the largest restaking protocol. It peaked above $20 billion TVL in mid-2025 before settling around $18 billion after activating slashing in April 2025. The protocol lets Ethereum stakers secure additional services (AVSs) while keeping their ETH productive. Its ecosystem now supports 40+ AVSs and has spawned liquid restaking protocols like Ether.fi, Renzo, and Puffer Finance that wrap EigenLayer positions into tradeable tokens. Despite a rocky year for the EIGEN token, the infrastructure continues to attract institutional operators including Google Cloud and Coinbase Cloud.

Bitcoin restaking emerged as a category in 2024-2025. Babylon leads the sector with roughly $4.4 billion in TVL, representing about half of all Bitcoin DeFi activity. Since Bitcoin uses proof-of-work rather than proof-of-stake, these protocols built infrastructure that lets BTC holders earn yield by securing proof-of-stake networks. Lorenzo Protocol, Lombard, and others issue liquid tokens (stBTC, enzoBTC) that represent restaked Bitcoin positions across 20+ chains. The total Bitcoin restaking ecosystem grew from under $100 million to over $6 billion in about 18 months.

Solana's restaking ecosystem is smaller but growing. Jito Restaking leads with approximately $34 million in TVL, followed by Fragmetric at around $30 million and Solayer at $25 million. Jito has accumulated over 14 million SOL in liquid staking TVL and recently expanded into restaking, where its TipRouter distributes MEV rewards directly to participants.

The mechanics differ across chains, but the core idea is the same everywhere: take staked assets, use them to secure additional services, and stack yield without giving up liquidity.

What Are LRTs And VRTs?

When you deposit an LST into a restaking protocol, you receive a token representing your restaked position. These tokens go by different names depending on the protocol: LRTs (liquid restaking tokens) or VRTs (vault receipt tokens). The terminology varies, but the function is the same.

An LRT or VRT is a claim on your underlying assets plus any rewards they generate. It tracks your share of a restaking vault, appreciates as rewards accrue, and remains liquid enough to trade, lend, or use as collateral. You can think of it as a receipt that says "this wallet owns X% of the assets in this vault," where X grows over time as staking and AVS rewards flow in.

Liquidity is what distinguishes these tokens from locked staking positions. Unlike native staking where your SOL is locked until you manually unstake and wait through a cooldown period, an LRT lets you exit by simply selling the token on a DEX. Liquidity depends on market depth, so large positions may face slippage, but for most users the ability to exit without waiting 2-3 days for unstaking is a meaningful upgrade.

How Do You Restake Solana?

The process takes about ten minutes across four steps.

Step one: get an LST. Go to a liquid staking provider like Sanctum, Jito, or Marinade, connect your wallet, and deposit SOL. You'll receive an LST within minutes that represents your staked position and appreciates as rewards accrue.

Step two: deposit into a restaking protocol. Navigate to Jito Restaking, Fragmetric, or Solayer, connect your wallet, select your LST, and deposit into a restaking vault. You'll receive an LRT or VRT in return.

Step three: decide what to do with your LRT. You can hold it and collect layered rewards, or go deeper by depositing into a lending protocol like Kamino, providing liquidity on Orca, or using it as collateral to borrow. Each additional layer adds yield and complexity.

Solana Liquid Restaking Protocols Compared

Fragmetric follows with around $30 million in TVL and 80,000+ participants. The protocol launched fSOL, a liquid staking token created through Sanctum's Staking as a Service product. Users can restake fSOL into fragSOL (Fragmetric's unified vault receipt token) to earn staking yield, MEV rewards, and restaking revenue from NCNs like Switchboard and Ping Network.

Fragmetric accepts many commonly traded LSTs including Sanctum partner LSTs like fSOL, JupSOL, dfdvSOL, RoXSOL, and bbSOL. It has also integrated dfdvSOL from DeFi Development Corp., a publicly-traded company making it a first among liquid restaking protocols on Solana.

Jito Restaking leads Solana's restaking market with approximately $34 million in TVL. Its TipRouter distributes MEV and priority fees directly to restakers, which means actual cash flow from block production rather than speculative points or future airdrops. Jito's restaking module allows users to stake virtually any SPL token to help secure Node Consensus Networks (NCNs). Jito doesn't offer its own user interface—instead, protocols like Kyros build on top of Jito's infrastructure. Kyros issues kySOL and kyJTO vault receipt tokens that let users access Jito restaking rewards while staying liquid.

Kyros is a liquid restaking protocol built on Jito's restaking infrastructure. Users deposit SOL, JitoSOL, or JTO and receive kySOL or kyJTO in return. These tokens earn staking rewards, MEV via TipRouter, and NCN rewards while remaining usable across DeFi—Kamino, Exponent, and Sandglass all accept kySOL.

Solayer holds approximately $25 million in TVL and takes a broader approach by letting you secure multiple AVS categories: MEV strategies, distributed computing, and oracle networks. Think of it as diversified restaking where your capital backs several services instead of concentrating on one. Solayer raised $12 million in seed funding led by Polychain Capital, with angel investors including Solana co-founder Anatoly Yakovenko.

What LSTs Can I Use For Liquid Restaking?

Your choice of LST sets your base yield and risk profile before restaking even enters the picture.

INF bundles multiple LSTs into a single basket token, earning staking rewards plus trading fees from the Infinity pool. It's accepted at Solayer and typically carries a higher base APY than single-validator LSTs.

fSOL, JupSOL, dfdvSOL, RoxSOL, and bbSOL are accepted by Fragmetric. If you want exposure to specific validators or already hold these tokens through Sanctum, Fragmetric provides a direct path to restaking.

JitoSOL and mSOL have the broadest acceptance across restaking protocols.

Where Does the Yield in Liquid Restaking Come From?

Asking where yield comes from is essential. Unsourced yield is usually someone else's money leaving, ponzinomics dressed up in APY figures. Restaking yield traces to identifiable revenue streams.

Base staking rewards (6–10% APY) come from Solana's inflation schedule. The network mints new SOL and distributes it to validators and their delegators for securing consensus. This is protocol-level income that's predictable and durable.

MEV and priority fees (1–3% additional) come from the value embedded in transaction ordering. Users pay priority fees when they want faster execution, and searchers pay to capture arbitrage opportunities. Protocols like Jito aggregate this value and route it back to stakers, turning real economic activity into real revenue.

AVS payments (variable) come from services that need security but don't want to bootstrap their own validator sets. An oracle network might pay restakers to back its price feeds, or a cross-chain bridge might pay for the economic security that makes its transfers trustworthy. These payments show up as token rewards, points, or direct distributions depending on the AVS.

Trading fees (1–2% for INF) come from users swapping between LSTs in the Infinity pool. More trading volume means more yield, following standard DeFi economics rather than inflationary rewards.

DeFi yield (variable) comes from what you do with your LRT after receiving it. Lend it on Kamino and earn borrower interest, provide liquidity on Orca and earn trading fees, or use it as collateral to borrow stablecoins and deploy that capital elsewhere. These layers are optional but can push total returns past 15%.

On sustainability: base staking and MEV are durable revenue streams tied to Solana's ongoing operation. AVS payments depend on those services finding product-market fit. Points and airdrops are promotional spending that will eventually taper. Build your strategy around the durable yields and treat the rest as bonus.

Why Is Solana Good For Restaking?

Ethereum invented restaking through EigenLayer. So why consider Solana?

Cost and speed determine capital efficiency. Solana transactions cost fractions of a cent and confirm in under a second, while Ethereum transactions cost dollars and take minutes. These lower costs and faster confirmations enable the whole point of restaking: you want to move assets between protocols, compound rewards, and adjust positions without friction eating your yield. On Ethereum, gas fees can wipe out weeks of earnings on smaller positions. On Solana, you can rebalance daily without thinking about costs.

Accessibility favors retail users. EigenLayer's complexity (slashing conditions, operator selection, long unbonding periods) makes it effectively institutional. Retail users can participate, but the learning curve is steep and the stakes are high. Solana's restaking protocols launched with retail in mind, offering simpler interfaces, lower minimums, and more liquid tokens.

Throughput enables more use cases. Solana handles thousands of transactions per second compared to Ethereum's 15-30 TPS on mainnet. For AVSs that need high-frequency operations like MEV routers, oracle updates, and gaming infrastructure, Solana's speed enables applications that would struggle on Ethereum.

Growth potential remains significant. About 13.9% of staked SOL is currently liquid (63M out of 415M total staked), while Ethereum's liquid staking penetration sits near 30%. If Solana converges toward Ethereum's ratio, the liquid staking market has room to more than double, and restaking will grow with it.

Ethereum's restaking ecosystem is larger, more battle-tested, and attracts more institutional capital. Solana's is younger, smaller, and carries more protocol risk. But for users seeking yield without five-figure minimums and triple-digit gas fees, Solana is where access actually exists.

FAQ

What's the difference between staking, liquid staking, and restaking?

Staking locks your SOL to secure the network, so you earn rewards but lose liquidity. Liquid staking gives you a tradeable token representing your stake, so you earn rewards while keeping the ability to sell, lend, or use your position as collateral. Restaking takes your liquid stake and uses it to secure additional services, earning extra yield while maintaining liquidity through another token layer.

What are the risks of liquid restaking?

Smart contract bugs could drain funds, and each protocol layer adds attack surface. Validator misbehavior or downtime affects rewards, though typically not principal. AVS failures could disrupt the services paying your yield. Liquidity crunches during market stress could force unfavorable exits.

To mitigate smart contract and validator risks, stick to audited protocols with track records, diversify across validators and AVSs, start with small positions, and never restake more than you can afford to lock for the 2–3 day unstaking period.

Which liquid restaking protocol should I start with?

Fragmetric is a good starting point. It accepts many common LSTs including fSOL, JupSOL, and dfdvSOL, and offers NCN rewards from Switchboard and Ping Network.

Can I lose my principal?

Yes, though it's unlikely with established protocols. Smart contract exploits are the main risk vector for losing your staked tokens.

How does Solana restaking compare to Ethereum restaking?

Ethereum's EigenLayer ecosystem holds roughly $18 billion in TVL compared to Solana's smaller restaking market of under $100 million combined. EigenLayer is more mature and attracts institutional capital, but it's also more expensive due to gas fees, more complex due to slashing and operator mechanics, and less accessible to retail users. Bitcoin restaking is also emerging as a major category, with Babylon alone holding over $4 billion. Choose based on your capital size, risk tolerance, and which ecosystem you're already active in.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice. The information provided should not be interpreted as an endorsement of any digital asset, security, or investment strategy. Readers should conduct their own research and consult with a licensed financial professional before making any investment decisions. The publisher and its contributors are not responsible for any losses that may arise from reliance on the information presented.