Table of Contents

Solana staking yields hover between 6-7% APY for most validators. But if you're holding SOL in a basic stake account, you're leaving money on the table. Liquid staking tokens now represent over 14% of all staked SOL, roughly $10 billion in value, and for good reason: LSTs let you earn staking rewards while keeping your capital deployable across DeFi, as you retain your liquidity when using them.

The real question isn't whether to use an LST. It's which one to choose. Yields vary across providers, from 5.7% to nearly 7% on base staking alone. However, the INF token at Sanctum operates on a fundamentally different model that has consistently outperformed traditional LSTs by capturing trading fees on top of staking rewards.

This guide breaks down the highest-yielding LSTs on Solana, explains why INF's architecture produces structurally better returns, and helps you decide which token fits your strategy.

What Is a Liquid Staking Token?

A liquid staking token represents SOL that's been staked with validators. When you deposit SOL into a liquid staking pool, you receive a token (like JitoSOL or mSOL) that tracks your share of the staking pool. As validators earn rewards, your token appreciates in value relative to SOL.

The core benefit is capital flexibility. Traditional staking locks your SOL for 2-3 days, whereas LSTs eliminate this friction. You can sell your position instantly, use it as collateral on lending protocols like Kamino or Jupiter Lend, and engage in any other DeFi activities that you fancy to amplify your overall yield return. And while you participate in these opportunities, your staked SOL keeps earning staking rewards, just like it would when natively staked.

How INF Differs from Traditional LSTs

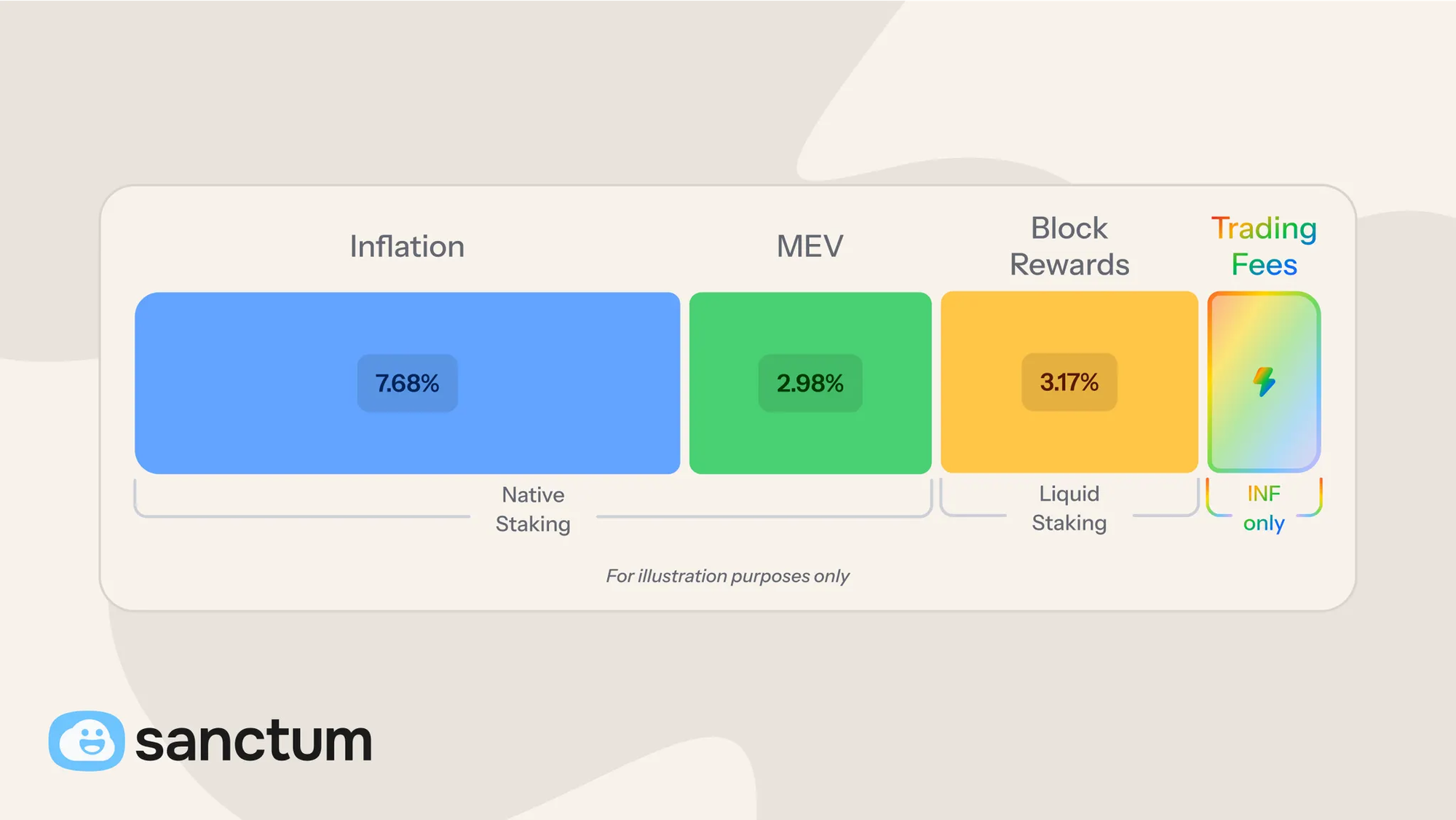

Most LSTs work the same way: the protocol stakes your SOL with a set of validators and gives you a token representing your share. JitoSOL stakes with Jito's validator network. mSOL stakes with Marinade's validators. The yield comes from one source: staking rewards (which now include MEV across nearly all major LSTs).

Sanctum's INF token takes a different approach. Instead of staking directly with validators, INF holds a basket of other LSTs, making it an “LST of LSTs.”

→ Infinity (INF) As An “LST Of LSTs

This allows INF to earn yield from two sources:

- The stake-weighted average of all the LSTs it holds (which includes their staking rewards and MEV)

- Trading fees collected when users swap between LSTs through Sanctum's Infinity liquidity pool

→ How INF enables LST-LST swaps

This second source is unique to INF. Sanctum operates a unified liquidity layer that enables instant swaps between any LST on Solana. Every swap generates a small fee (8 basis points), and those fees flow to INF holders. During periods of high trading activity, this fee income meaningfully boosts returns. In some epochs with liquidity pressure on other LSTs, INF has delivered APYs exceeding 20%.

Over the last year, INF has outperformed leading Solana LSTs by approximately 20%. Actual performance varies based on LST swap volume, and past results don't guarantee future returns.

The 9 Best Solana LSTs by Yield

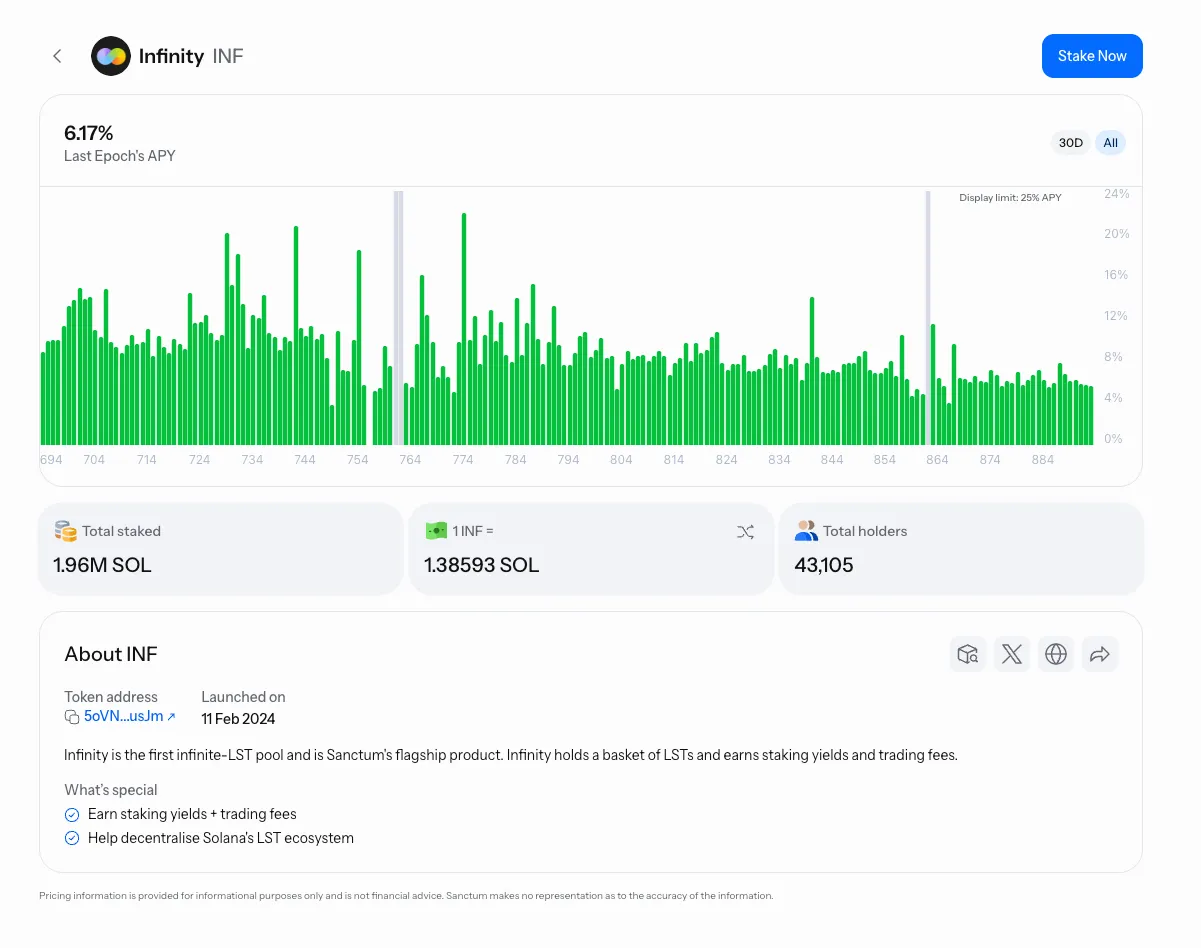

1. Sanctum Infinity (INF)

APY (last 10 Epochs): 6.68%

Total SOL Staked: 1.9M

Holders: 43,103

When you look at the numbers, INF regularly has the best yield with the current highest yield out of any LST with more than 200k staked SOL at 6.68%. Infinity combines a deep holder base, large staking volume, high yield, and robust security into an industry-leading package. While other LSTs depend solely on validator performance, INF captures both staking rewards from its underlying LST basket and trading fees from Sanctum's liquidity pool.

The Infinity liquidity pool holds a rotating basket of high-performing LSTs, automatically rebalancing to favor those with better yields. When you hold INF, you're effectively diversified across the entire Solana LST ecosystem rather than concentrated in a single protocol's validator set. You can compare real-time yields across all LSTs on Sanctum's platform.

Infinity performs best in times of market uncertainty by providing liquidity. Infinity yields occasionally exceeding 25% APY in a single epoch during market stress events like the recent bnSOL depegging in October 2025.

Pros:

- Dual yield from staking rewards plus trading fees

- Diversified exposure across multiple LSTs reduces single-validator risk

- Instant redemption for SOL or any underlying LST

- Proven track record of outperformance versus single-asset LSTs

- Deep DeFi integrations, including Jupiter Lend and Kamino.

- Instant unstaking available

- Performs best in times of market uncertainty

Cons:

- APY can be volatile depending on trading volume, but has historically been strong and, on average, outperforms other LSTs.

Best for: Yield-focused stakers who want the highest sustainable returns.

2. dSOL (Drift)

APY (last 10 Epochs): 6.52%

Total SOL Staked: 1.7M

Holders: 5,151

Drift Protocol launched dSOL to integrate liquid staking directly into its perpetuals and lending platform. The token stakes with Drift's validator and passes through standard staking rewards plus MEV.

The real value proposition is native integration with Drift's ecosystem. If you're already trading perps or using Drift's lending markets, dSOL slots in seamlessly as collateral. The protocol has been running since 2021 and recently upgraded to v3 with sub-400ms execution for market orders.

Pros:

- Native integration with Drift's perpetuals and lending

- Competitive yield among single-validator LSTs

- No withdrawal fees

- Backed by an established DeFi protocol with a strong track record

Cons:

- Smaller holder base and liquidity compared to larger LSTs

- Single validator concentration risk

Best for: Drift users who want unified collateral across trading and staking.

3. JupSOL (Jupiter)

APY (last 10 Epochs): 6.26%

Total SOL Staked: 4.8M

Holders: 30,052

Jupiter built JupSOL on Sanctum's infrastructure, combining the DEX's validator with Sanctum's liquidity layer. The validator runs 0% commission and passes 100% of MEV back to stakers. Jupiter also delegates an additional 100K SOL to boost yields during the bootstrapping phase.

The tight integration with Jupiter's DEX means JupSOL benefits from priority transaction inclusion during network congestion. If you're routing trades through Jupiter regularly, holding JupSOL can improve your execution.

Pros:

- 0% commission validator with full MEV pass-through

- Built on Sanctum's audited infrastructure

- Deep liquidity across Jupiter's DEX routing

- Transaction priority benefits for Jupiter users

Cons:

- Single validator

- Yield premium from bonus delegation will normalize over time

Best for: Active Jupiter users who want staking yield with DEX benefits.

→ Case Study: A Deep Dive Into JupSOL

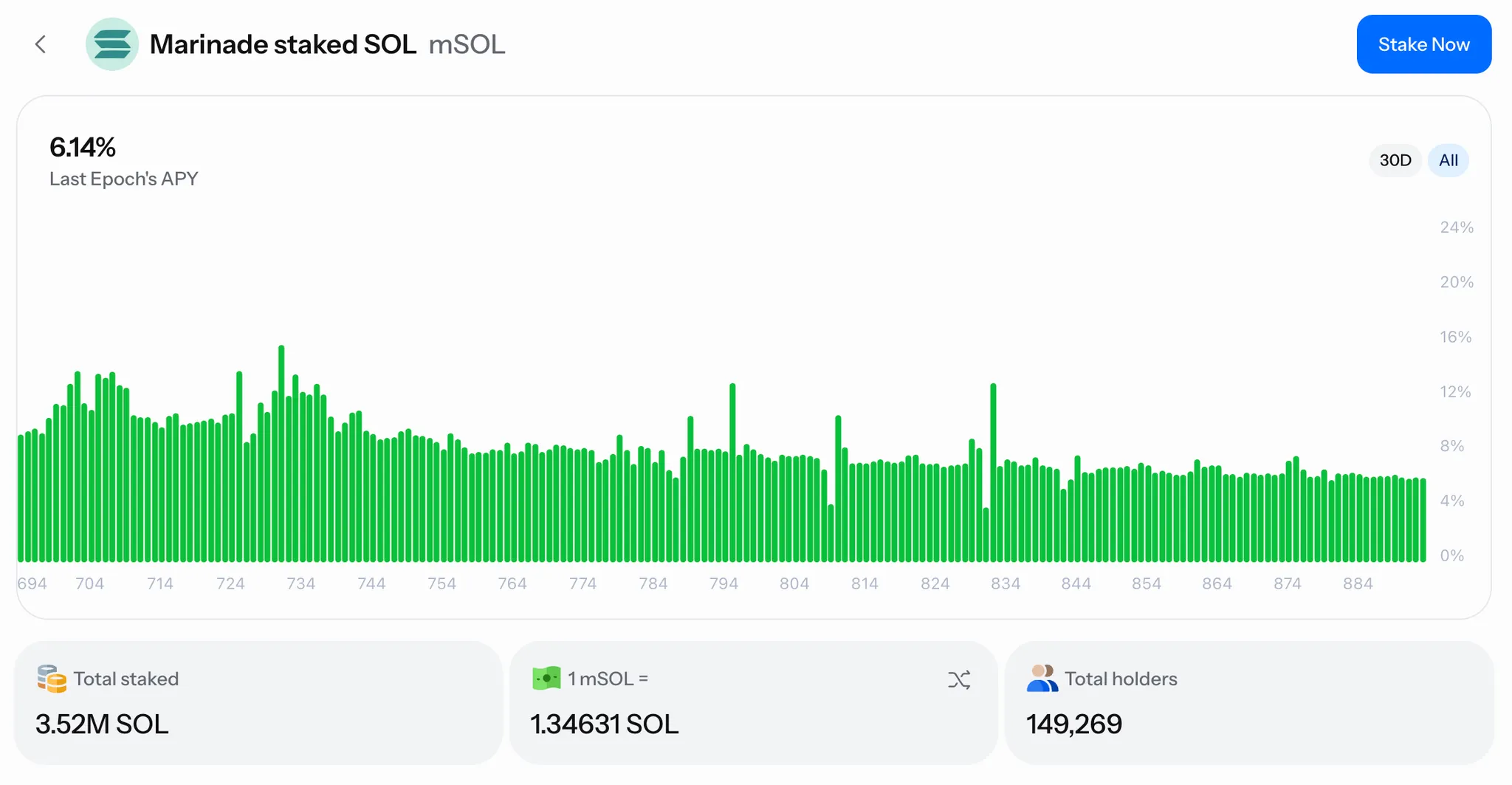

4. mSOL (Marinade)

APY (last 10 Epochs): 6.24%

Total SOL Staked: 3.5M

Holders: 149,269

Marinade distributes stake across 100+ validators and is one of the larger LSTs by total SOL staked and number of holders.

mSOL's market share has declined as competitors launched, but it remains integrated across Solana DeFi. The Stake Auction Marketplace (SAM) lets validators bid for delegation, which can boost yields during competitive periods.

Pros:

- Broad validator distribution across 100+ nodes

- Established DeFi integrations

- Instant unstaking available

Cons:

- 6% protocol fee on staking rewards

- Yield has lagged newer competitors

Best for: Users who prioritize validator diversity and have existing mSOL positions.

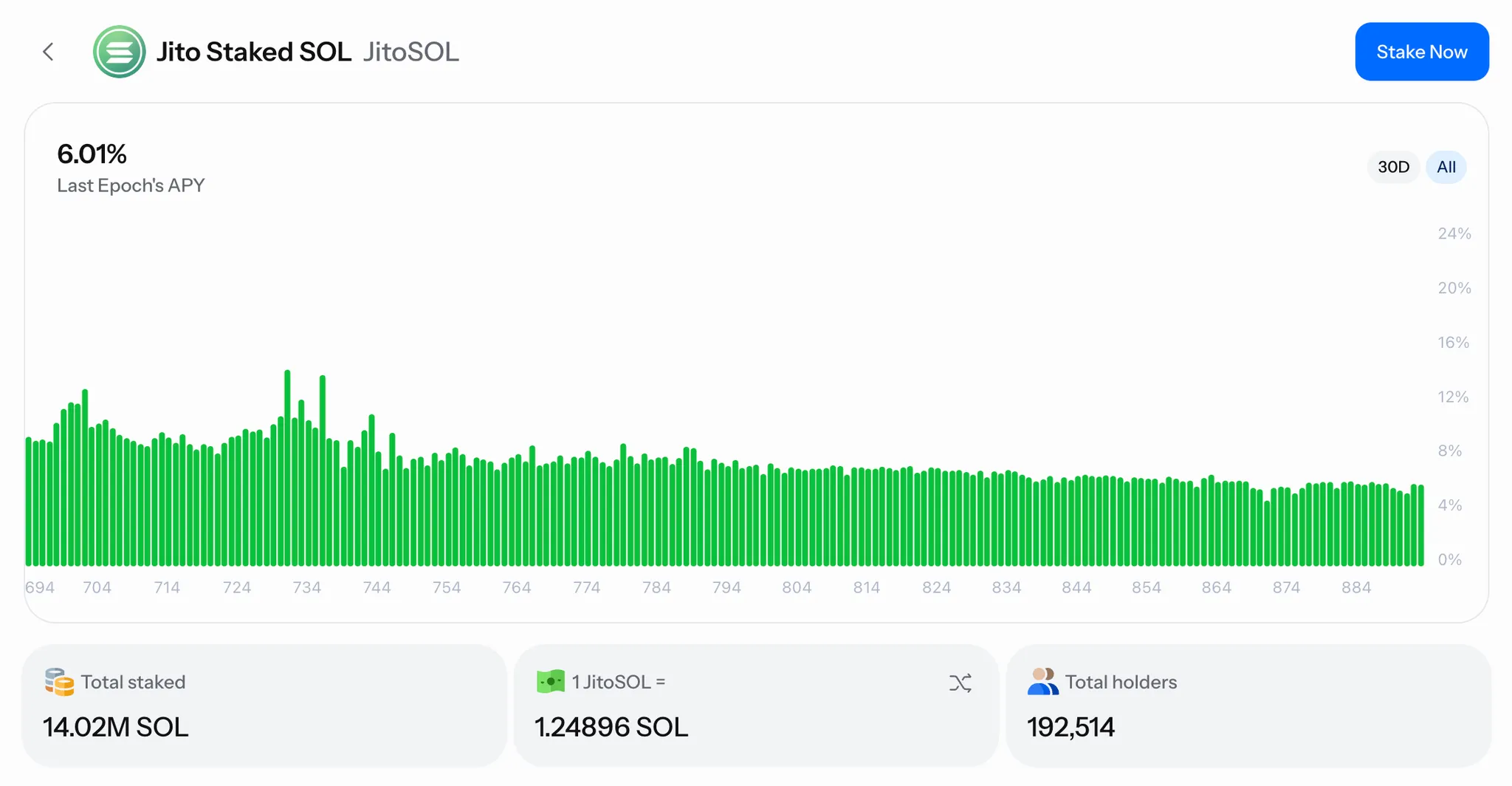

5. JitoSOL

APY (last 10 Epochs): 5.9%

Total SOL Staked: 14M

Holders: 192,514

JitoSOL is currently the largest LST on Solana by total stake. The protocol delegates across 200+ validators with rebalancing based on performance. Scale brings liquidity advantages, and JitoSOL has wide DeFi integrations across the ecosystem.

That said, size hasn't translated to yield leadership. At 5.9% APY, JitoSOL trails most alternatives on this list. The 4% performance fee and the operational overhead of managing such a large stake pool contribute to the gap.

Pros:

- Deepest liquidity for large position entries and exits

- 200+ validator delegation reduces concentration risk

- Wide DeFi integrations

Cons:

- 4% performance fee

- APY more optimized LSTs

Best for: Large holders who prioritize liquidity depth and broad validator distribution.

6. bbSOL (Bybit)

APY (last 10 Epochs): 5.88%

Total SOL Staked: 1.7M

Holders: 11,521

Bybit launched bbSOL in partnership with Sanctum as the first exchange-backed LST on Solana. The token benefits from Bybit's validator infrastructure and the exchange's institutional credibility.

For Bybit users, bbSOL offers a path to earn staking yield while maintaining easy conversion back to exchange holdings. The Sanctum integration means bbSOL plugs into the broader LST liquidity layer despite being exchange-native.

Pros:

- Exchange-backed with institutional infrastructure

- Sanctum integration provides ecosystem liquidity

- Easy on/off ramp for Bybit users

- No management fees

Cons:

- Smaller holder base than DeFi-native LSTs

Best for: Bybit users who want staking yield without leaving the exchange ecosystem.

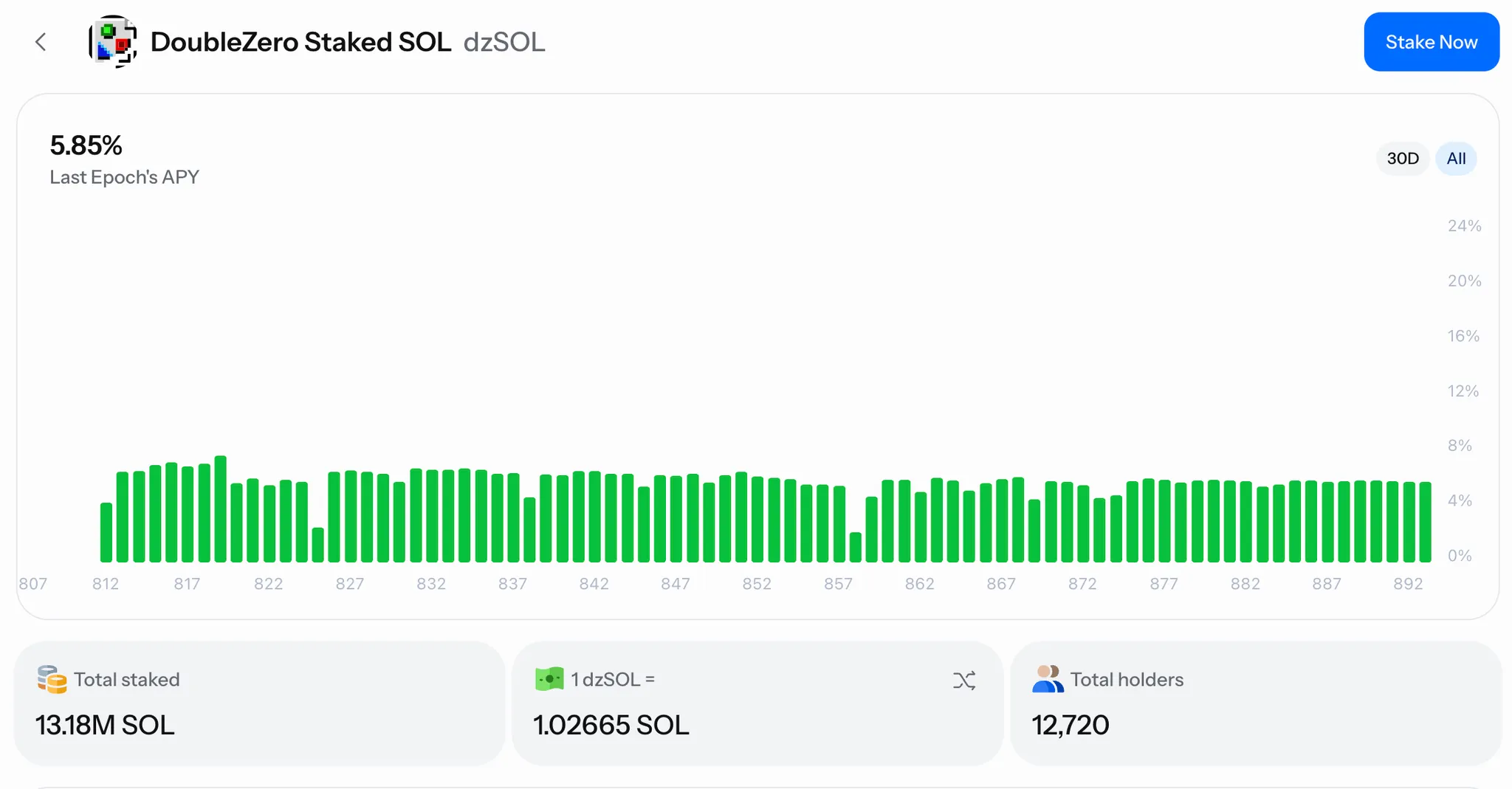

7. dzSOL (DoubleZero)

APY (last 10 Epochs): 5.86%

Total SOL Staked: 13.1M

Holders: 12,736

DoubleZero is a newer entrant that has grown rapidly, accumulating over 13M SOL in stake. The protocol focuses on validator performance optimization and has attracted significant institutional interest.

Despite being relatively new, dzSOL has achieved scale comparable to established players.

Pros:

- Rapid growth demonstrates industry confidence

- Large stake pool provides stability

- Competitive fees

Cons:

- High stake concentration among fewer holders

- Less DeFi integration than established LSTs

- Lower historical yield compared to other LSTs on this list

Best for: Institutions seeking a newer protocol with significant scale.

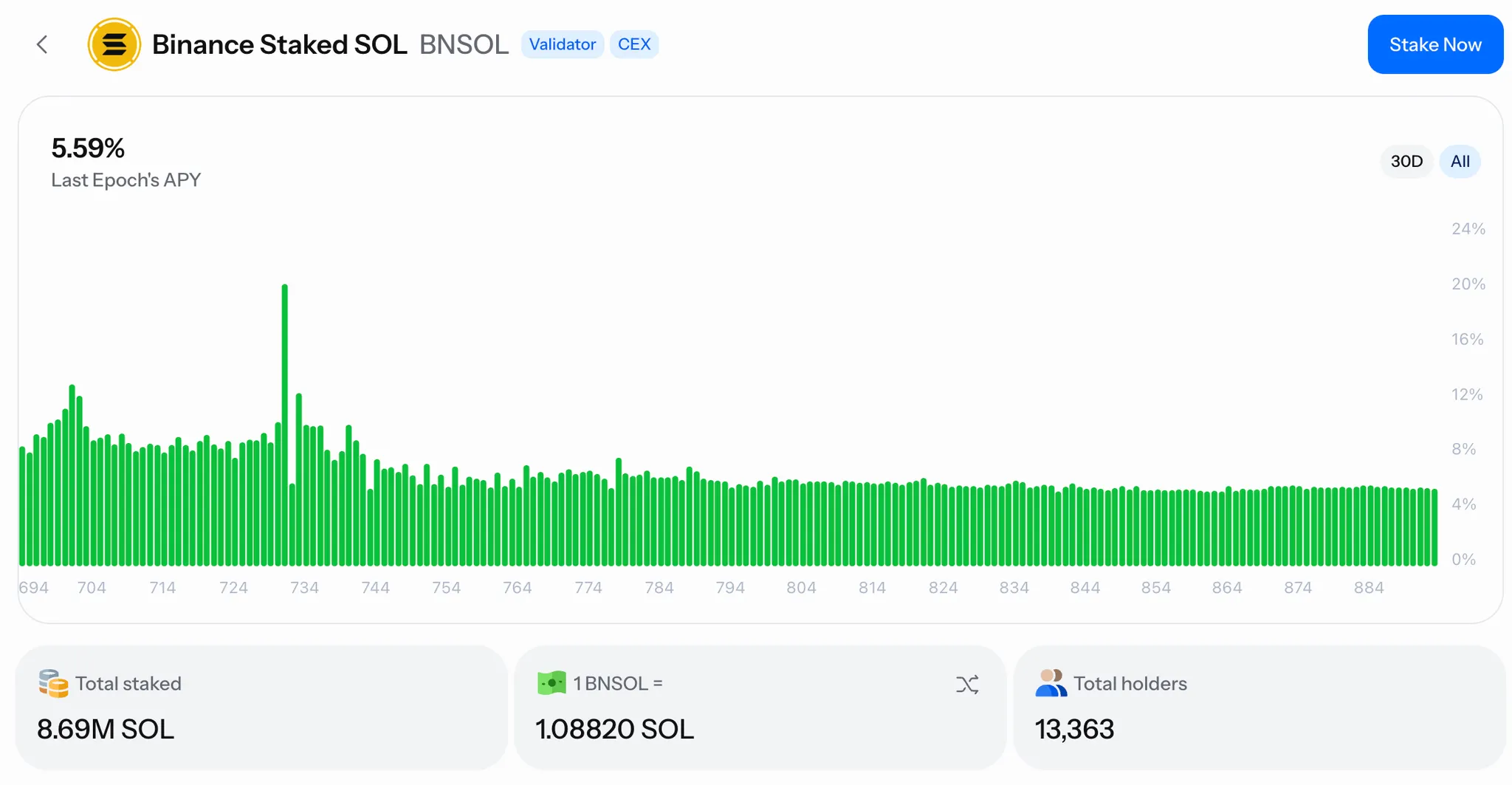

8. bnSOL (Binance)

APY (last 10 Epochs): 5.7%

Total SOL Staked: 8.6M

Holders: 13,363

Binance's bnSOL brings the world's largest exchange into Solana liquid staking. The token leverages Binance's validator infrastructure and offers seamless integration for users already on the platform.

The tradeoff is clear: bnSOL offers lower yields than DeFi-native alternatives but provides the familiarity and trust of Binance's brand. For users who primarily operate within the Binance ecosystem, it's a convenient way to earn staking yield.

Pros:

- Backed by the world's largest crypto exchange

- Easy integration for Binance users

- Large stake pool provides liquidity

- Institutional-grade infrastructure

Cons:

- Lowest APY among major LSTs

- Centralized exchange dependency

- Limited DeFi composability outside Binance

Best for: Binance users who prioritize convenience over yield optimization.

9. fwdSOL (Forward Industries)

APY (last 10 Epochs): 5.68%

Total SOL Staked: 1.7M

Holders: 42

Forward Industries (NASDAQ: FWDI) launched fwdSOL in December 2025 as part of its Solana treasury strategy. The company holds over 6.9 million SOL (roughly $1.5B) and converted approximately 1.7M SOL (25% of its holdings) into this LST through a partnership with Sanctum.

fwdSOL represents a template for institutional adoption of liquid staking. Forward Industries uses the token as collateral for DeFi borrowing strategies, demonstrating how public companies can deploy treasury assets productively while maintaining staking yield. The strategy is backed by Galaxy Digital, Jump Crypto, and Multicoin Capital.

Kyle Samani, Chairman of Forward Industries, noted that liquid staking provides flexibility to capture incremental yield sources beyond passive staking while maintaining liquidity. The launch signals growing institutional confidence in LSTs as treasury management tools. Sanctum's Staking-as-a-Service platform enables enterprises to launch custom LSTs with turnkey infrastructure.

Pros:

- First publicly traded company LST on Solana

- Built on Sanctum infrastructure with full liquidity access

- Institutional-grade compliance and oversight

- Template for corporate treasury deployment

Cons:

- Very small holder base (primarily Forward Industries) due to its recent launch

Best for: Institutional reference for how public companies can approach liquid staking.

→ Forward Industries DAT Launches fwdSOL LST

Comparison Table

| LST | APY (10 Epochs) | SOL Staked | Holders | Key Differentiator |

|---|---|---|---|---|

| INF | 6.68% | 1.9M | 43,103 | Highest Yield |

| dSOL | 6.52% | 1.7M | 5,151 | Drift Protocol integration |

| JupSOL | 6.26% | 4.8M | 30,052 | Jupiter ecosystem |

| mSOL | 6.24% | 3.5M | 149,269 | Validator decentralization |

| JitoSOL | 5.9% | 14M | 192,514 | Scale |

| bbSOL | 5.88% | 1.7M | 11,521 | Bybit exchange backing |

| dzSOL | 5.86% | 13.1M | 12,736 | Rapid institutional growth |

| bnSOL | 5.7% | 8.6M | 13,363 | Binance ecosystem |

| fwdSOL | 5.68% | 1.7M | 42 | Public company treasury |

APY figures represent last 10-epoch yields and fluctuate based on validator performance, network conditions, and (for INF) trading volume. Past performance does not guarantee future results.

Why Sanctum Infinity Has the Highest Yield

The yield gap between INF and traditional LSTs isn't an accident.

Traditional LSTs are capped at whatever their validators produce. They all access roughly the same staking rewards and MEV opportunities. The differences come down to validator selection, fee structures, and operational efficiency. They aren’t identical products, but there are marginal differences in returns.

INF breaks this ceiling by adding a second yield source. Every time someone swaps between LSTs through Sanctum's Infinity liquidity pool, a small fee accrues to INF holders. This fee income scales with ecosystem activity. During volatile market periods when LST holders’ swapping activity increases, INF's yield spikes.

The comparison data bears this out. Over roughly 50 epochs in Q3 2025, INF outperformed JitoSOL by 28% and mSOL by 20%. Staking 100 SOL in INF over 11 months would have earned approximately 2.11 SOL more than the same stake in JitoSOL. These figures reflect historical performance during varying market conditions and may not predict future results.

This doesn't mean INF is always the right choice. Returns are more variable depending on trading activity. During low-volume periods, INF's unstaked reserve can create "SOL drag" that reduces yields. But for yield-focused stakers who want maximum sustainable returns, INF's structure gives it a persistent edge when the LST market is active.

→ Start earning higher yields with Sanctum Infinity

FAQs

What is a Solana liquid staking token?

A liquid staking token represents SOL that has been staked with validators while remaining tradeable. When you deposit SOL into an LST protocol, you receive a token that tracks your share of the staking pool and appreciates as rewards accrue. This lets you earn staking yield (typically 5.7-6.7% APY) without locking your capital, since you can sell, trade, or use the LST as DeFi collateral at any time.

How do I choose the right LST for yield?

Prioritize LSTs that capture multiple yield sources rather than staking rewards alone. INF earns both staking yields and trading fees, which is why it consistently leads on APY. Beyond raw yield, consider your use case: if you trade on Jupiter, JupSOL offers ecosystem benefits; if you use Drift, dSOL integrates natively. Check the APY over 10+ epochs rather than single snapshots, since short-term yields can be misleading.

Is Sanctum INF better than JitoSOL?

For yield optimization, INF has historically outperformed. Over roughly 50 epochs in Q3 2025, INF delivered approximately 28% higher returns than JitoSOL, driven by its dual yield structure. JitoSOL offers deeper liquidity and a larger holder base, which matters for very large positions. If maximizing returns is your priority and you're comfortable with INF's different risk profile (basket exposure rather than direct validator selection), INF has shown stronger yield performance. That said, past performance varies with market conditions and doesn't guarantee future results.

Can I use INF in DeFi?

Yes. INF integrates with major Solana DeFi protocols including Jupiter Lend, Kamino, Drift, and Orca. You can use INF as collateral for borrowing, provide liquidity in pools, or deploy it in yield vaults. The token earns staking yields in your wallet without any action required, and you can layer additional DeFi strategies on top. See the full list of INF DeFi integrations.

What are the risks of liquid staking?

Smart contract risk is the primary concern: if there's a bug in the staking protocol, funds could be at risk. INF mitigates this through multiple audits (OtterSec, Sec3, Neodyme) and builds on Solana's SPL stake pool program, which has nine independent audits. Depeg risk exists during market stress, when LSTs can temporarily trade below their redemption value. INF reduces this through its reserve pool and multi-LST diversification.

How quickly can I unstake from INF?

Instantly. You can redeem INF for SOL or any underlying LST through Sanctum's unified liquidity layer with minimal slippage. There's a 0.10% withdrawal fee (10 basis points) for redemptions. Unlike native staking, which requires a 2-3 day cooldown, INF provides immediate liquidity.

What's the difference between INF and traditional LSTs?

Traditional LSTs like JitoSOL or mSOL stake directly with validators and earn only staking rewards. INF holds a basket of LSTs and earns both the underlying staking rewards plus trading fees from Sanctum's liquidity pool. This dual-source structure produces higher yields and diversifies risk across multiple protocols rather than concentrating in a single validator set.

What's the best alternative to Marinade for higher yields?

Sanctum INF. Recent yields have mSOL around 6.24%, while INF delivers 6.68% through its additional trading fee income. Historically, INF has also had better yields. INF also provides exposure to multiple LSTs through its basket approach, offering diversification across validator sets while generating better returns.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice. The information provided should not be interpreted as an endorsement of any digital asset, security, or investment strategy. Readers should conduct their own research and consult with a licensed financial professional before making any investment decisions. The publisher and its contributors are not responsible for any losses that may arise from reliance on the information presented.