Table of Contents

Silhouette has launched Shielded Spot Trading in open beta following several months of refinement with traders and users.

What’s live:

- Shielded Spot HYPE/USDC, available via Silhouette’s app and API

- Two execution modes:

- Naked: works exactly as trading does on Hyperliquid or any Builder Code frontend

- Shielded: trades are executed using the Silhouette environment and a delegated wallet, based on user instructions

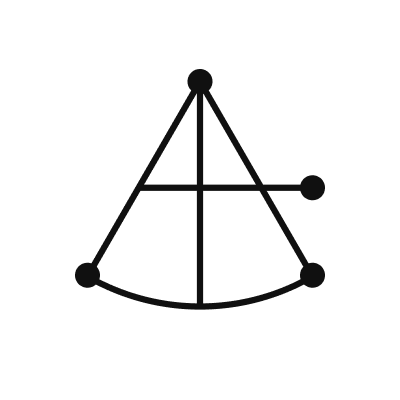

How it works:

- Users deposit funds into a contract wallet

- This wallet processes and executes trades based on instructions initiated by the user through the Silhouette TEE

- Trades execute directly on the Hyperliquid orderbook

- After execution, balances are encrypted within a smart contract

- User funds remain under user control at all times

This smart contract will also be used for Silhouette’s upcoming Sovereign Withdrawal feature, which is designed to ensure access to funds even if the Silhouette system is unavailable.

Silhouette supports policy engines as part of its plan to introduce compliance into the system, alongside its stated commitment to open finance and making crypto markets accessible to traditional financial participants.

Funds and institutional users interested in utilizing the feature from launch are encouraged to reach out via Silhouette’s public Telegram group.

What this enables today:

- Trades are shielded by the wallet’s total trading volume

- Lower fees are planned, with work underway to make Silhouette the cheapest venue to buy HYPE

- The TEE acts as a conduit for user intents on Hyperliquid while maintaining user control of funds

Looking ahead, Silhouette notes that HIP-3 deployers, spot buyers, and spot equities buyers will be able to discretely accumulate HYPE and other spot assets at the best possible prices, supported by customizable policy engines.

What’s Next:

- More trading pairs

- HIP-3 markets on naked perps

- Shielded TWAP and VWAP as part of an iceberg execution suite

- RFQ and RFM infrastructure for larger workflows

- A net settlement layer to reduce price impact

This release represents the first phase of a broader execution engine roadmap, with future updates planned to introduce deeper intent protection, more expressive order types, and confidential routing that still settles publicly.